Key Metrics

A Snapshot of the Economic and Healthcare Landscape |

|

|

Macroeconomic Snapshot

Macroeconomic signs headed in a (mildly) positive direction. Economy is growing (slightly), unemployment is declining (slightly), inflation remains low, and consumer confidence is improving (slightly). |

|

|

| Economic Growth (GDP) Slowly Improving

|

|

+3.0% in Oct–Dec 2011

– Growth for 2012 projected at 2.0% to 2.5%, was +1.7% in 2011

|

|

|

| Inflation Remains Low

|

|

CPI 3.6% past 12 mos. (through March); 2% expected in 2012

|

|

|

| Consumer Confidence

|

|

Dipped slightly in April after 13-month high in March

|

|

|

| Unemployment Slowly Declining

|

|

8.2% in March; down from 9.1% in Sept

– Some of decline due to people abandoning job searches

– Experts expect unemployment of 8% at end of 2012

|

|

|

Healthcare Snapshot

Hospitals are focused on the patient experience, cost savings and M&A. |

|

|

| Healthcare Spending

|

|

+5.28% in 2011 (growth in average per capita cost)

– Healthcare costs ˜2x inflation

– Costs covered by commercial insurance grew 7.1%

– Costs covered by Medicare grew 2.5%

|

|

|

| Spending Concentration

|

|

1% of population accounts for 21.8% of healthcare spending

|

|

|

| Use of Healthcare Products/Services

|

|

Visits to the doctor fell by 4.7%

– Number of prescriptions declined 1.1% last year

– Prescriptions for those 65 and older declined 3.1%

– In 1999, there were 3.0 hospital beds per 1,000 people; in 2009 it was 2.6 — a drop of 13.3%

|

|

ER visits increased 7.4% in 2011

|

|

|

| Healthcare M&A Expected to Continue

|

|

|

– 2011 a record-breaking year for hospital M&A

– The trend is expected to continue in 2012

– 80% of health leaders say they have a deal underway or expect to in the next 12–18 months

|

|

|

| Health Leaders’ Top Priorities

|

|

|

1. Patient experience and satisfaction

2. Cost reduction and process improvement

3. Payment reform, reimbursement, value-based purchasing and accountable care

4. Clinical quality and safety

Health leaders see the opportunities for savings in labor, supplies, admin overhead and IT systems.

|

|

|

| Hospital Revenue

|

|

3.5% (seasonally adjusted) in the fourth quarter 2011

|

|

|

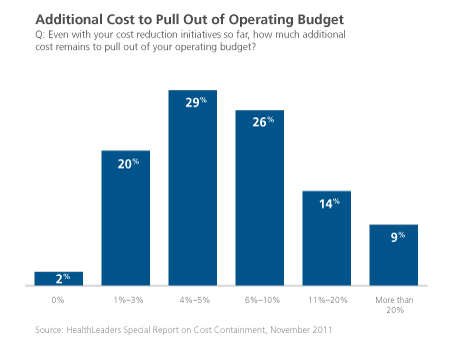

| Emphasis on Cost Savings

|

|

|

– 99% of hospitals have saved from cost-reduction programs over the past three years; 50% saved 4% to 10%

– But more cost cuts are needed

|

|

|

|

| McKesson Idea Exchange

|

- What aspects of your business are increasing (which areas/departments), and what is declining?

- What cost-savings initiatives have you engaged in over the past few years? How have they worked? What are your main cost-savings initiatives?

- What is your organization’s M&A strategy?

- What are your organization’s top priorities?

|

|

Back to Top

|

Key Topics

Topic 1: Public Policy |

The constitutionality of the Affordable Care Act will be ruled on soon, with far-reaching implications. Regardless of how the Supreme Court rules, parts of ACA are moving ahead. |

|

|

| Supreme Court Decision Awaits (See CNN article)

|

- On March 26, 2012, the U.S. Supreme Court heard oral arguments about ACA’s constitutionality.

- Key issues are the individual mandate and if Medicaid expansion unduly burdens states.

- The public is divided. Legal experts have differing views. No one knows how the Court will rule.

- A decision is expected by the end of June 2012.

|

|

|

| The Court’s Decision Will Have an Economic Impact

|

- The Urban Institute has analyzed the impact if ACA is upheld:

- About 8% of the population, or 26.3 million uninsured Americans, will have to get insurance or pay a penalty.

- 8.1 million will be eligible for free (or close to free) insurance through Medicaid or CHIP.

- 10.9 million will be eligible to purchase subsidized non-group coverage through health insurance exchanges (HIXs).

- That leaves only 7.3 million uninsured (3% of the population) who will be required to buy insurance, but won’t qualify for free insurance or subsidies.

- The Urban Institute says that even though only a relatively small number of people will be affected, the individual mandate provides a large benefit. Insurance markets would be more stable and premiums on policies people buy themselves would be 10% to 20% lower.

- Rand has models showing the impact of the lack of an individual mandate

- With the mandate, about 252 million people will be insured in 2016. Without it about 240 million will be covered.

- Rand estimates that without a mandate, premiums would cost 9.3% more but insurance purchased by individuals through a HIX would only be 2.4% higher.

- Without the mandate, Rand estimates federal spending would be $10 billion higher for 2016.

|

|

|

| Significant Challenges for Academic Medical Centers

|

- A PwC Study on the future of academic medical centers (AMCs) says that more than 10% of revenue may be under threat from ACA and federal budget cuts, such as cuts to indirect medical education.

- With operating margins averaging 5%, AMCs are under pressure.

- New quality metrics also put pressure on AMCs.

- PwC suggests five strategies for AMCs:

- Hold faculty accountable for cost and quality.

- Become part of a larger healthcare community network. This means partnering with high-quality, low-cost providers like community hospitals.

- Leverage technology to extend reach and effectiveness.

- Become an information hub.

- Align the research pipeline with clinical and business strategies.

|

|

|

| While Awaiting a Court Ruling, ACA Is Moving Forward

|

- On April 10, 2012, CMS announced the first 27 ACOs to participate in the Shared Savings Program. The 27 ACOs are listed here.

- 150 more applications are being reviewed by CMS.

- This follows 32 “Pioneer” ACOs announced on December 19, 2011. (Pioneer ACOs listed here.)

- In a HealthLeaders survey, 48% of hospital executives anticipate that their organization will be part of an ACO within three years.

- In March the Congressional Budget Office decreased its 10-year Medicare spending projection by $69 billion. Part of the change is based on savings from ACOs

|

|

|

| McKesson Idea Exchange

|

- How do you believe the individual mandate will affect your organization? Financially? Operationally?

- Is any of your revenue at risk from healthcare reform or federal budget cuts? What strategies is your organization using to sustain margins amid these cuts?

- What is your organization’s strategy for becoming an ACO? What changes do you anticipate in the next few years?

|

|

Back to Top

|

Key Topics

Topic 2: Quality and Patient Safety |

Quality remains a priority in most organizations and produces a positive ROI. The greatest barrier to quality is lack of organizational collaboration. |

|

|

| Quality Remains a Priority

|

- In a 2012 survey of hospital CEOs, clinical quality and safety ranked as the no. 4 priority, after reimbursement, patient experience and cost reduction

- 34% of CEOs rank it as a “top three” priority

|

|

|

| Absence of Coordination Hurts Quality

|

- Healthcare leaders see the greatest strategic challenge for clinical quality improvement as care coordination and continuum of care

- Only 14% of leaders say their organization’s care coordination is “very strong”

- 17% rate their organization’s coordination as weak or very weak

- 49% of health leaders believe that M&A activities will result in better quality of care

|

|

|

|

| Quality Initiatives Deliver Savings

|

- The Michigan Health and Hospital Association has found that investments in quality typically provide a return on investment ranging from 2:1 to 9:1.

- Henry Ford Health System in Detroit has reduced preventable infections by 45%, and by reducing complications after surgery, length of stay has been reduced by 1.9 days. As a result of improving quality and safety, the health system has decreased costs 8% to 9% per year, saving $10 million over four years.

|

|

|

| New Initiative to Improve Drug Safety and Medication Adherence

|

- At the HIMSS conference in February 2012, an initiative was announced by the FDA and several EHR vendors to improve drug safety and medication adherence

- This initiative focuses on integrating drug services for prescribers and their patients into electronic health record platforms and other health information technology

- The initiative will provide time-sensitive alerts, integrated adverse-drug-event reporting, and drug information and adherence tools

|

|

|

| McKesson Idea Exchange

|

- Where does clinical quality and safety rank as a priority in your organization?

- What are the challenges to delivering even better clinical quality in your organization?

- How would you assess your organization’s level of coordination?

- How integrated is pharmacy as part of coordination?

|

|

Back to Top

|

Key Topics

Topic 3: Supply Chain |

The focus of hospital supply chains is saving money. Many approaches are being used: evolving the overall supply-chain model, creating a Chief Purchasing Officer position, finding ways to improve efficiency that don’t require capital investments and improving supply-chain security. |

|

|

| Hospital Supply Chains Go through Stages of Maturity

|

- Consulting firm Booz & Company sees hospital supply chains at three levels of maturity:

- Foundation model. This is the most basic type of supply chain. At this stage, hospitals simply focus on ensuring that supplies are in stock. This is a minimalistic supply chain that focuses on operations and materials management with limited strategic capabilities.

- Optimization model. This is a more advanced model that uses a hospital-wide approach to reduce costs and improve efficiency. Hospitals take a more strategic approach to supply-chain management and build capabilities to improve predictability and control.

- Transformation model. The most mature hospital supply chains, which are rare, balance cost control with patient outcomes. This typically occurs after an organization has already engaged in cost-optimization efforts and now focuses on overall value.

- Transformation requires collaborative governance, streamlined processes and integrated systems.

|

|

|

| Hospitals Are Creating CPO Positions to Reduce Costs

|

- A consultant from McKinsey says that over the past 10 years more health systems and hospitals have created a “Chief Purchasing Officer” position

- The responsibilities of CPOs have grown as hospitals focus on controlling costs

- Strategies used by CPOs to control costs include product standardization and contracting directly with manufacturers, instead of purchasing some products through distributors and GPOs

- CPOs and supply-chain departments are also involved in M&A activities to realize synergies

|

|

|

| Supply-Chain Costs Can Be Controlled without Major Capital Investments

|

|

The executive director of the Health Industry Distributors Association Educational Foundation offered several ideas to control the supply chain that have low capital intensity:

|

- Focus on product standardization — buy more of the same items

- Work with distributors to create a custom formulary

- Adopt a just-in-time model where products arrive ready to use

- Maximize spend through a prime distributor

|

|

|

| Some Pharma Players Advocating New Track-and-Trace Law

|

- The proposed RxTec Act, advocated by some members of the pharma supply chain, includes a phased-in national approach to track-and-trace, with uniform federal requirements (that replace inconsistent state requirements)

- This approach would automate lot-level tracking using barcodes

- This act is currently a work in progress

- A McKesson spokesperson is quoted saying that McKesson supports several aspects of the proposed RxTec Act, but McKesson supports tracing products at the unit level

|

| McKesson Idea Exchange

|

- How would you describe the maturity of your hospital’s supply chain?

- How is the supply chain managed within your organization? Who oversees it? What is their title? Priorities?

- What initiatives are being undertaken in your organization to control supply-chain costs?

|

|

Back to Top

|

Key Topics

Topic 4: Reimbursement |

Huge reimbursement cuts from Medicare make reimbursement the no. 1 issue for hospital executives. This is what is driving the focus on cost-savings activities. |

|

|

| Reimbursement Is No. 1 Priority of Healthcare Leaders

|

- Survey of hospital CEOs ranks reimbursement as top priority

- The reason why reimbursement is the top priority is huge cuts to hospital payments as part of healthcare reform

- Bloomberg Government labels hospitals the biggest loser in healthcare reform due to $155 billion in Medicare reimbursement cuts through 2020

|

|

|

| Cuts to Medicare Forcing Hospitals to Save Costs

|

- Four of 10 hospital stays are financed by Medicare

- Medicare accounts for 35% to 55% of the average hospital’s revenue

- Medicare typically pays 70% to 80% of what a commercial payor pays

- Becker’s Hospital Review offers several strategies for hospitals to break even on Medicare:

- Know your Medicare data. Different hospitals have different percentages of Medicare patients. It is important to understand how important Medicare is and to understand information such as total charges, covered charges, total days, number of discharges and more.

- Have clear productivity targets. Tracking these targets and improving productivity improves margins on Medicare.

- Partner with physicians to reduce clinical variation. There is often significant variation in resource consumption. Organizations need consistency, especially as value-based purchasing approaches.

- Look at “big bucket” operations savings. Big buckets include the supply chain, energy, shipping, food and other aspects of operations. There are usually big savings opportunities in each area.

- Explore bundled payments. There are best practices for bundled-payment success, such as which DRGs to bundle.

- Improve OR and ER operations. These are important areas of the hospital that often have a great deal of waste.

- Consider partnerships. Affiliations and partnerships may provide ways to offset declining reimbursements.

|

|

|

| Readmissions Are Receiving Much Attention

|

- Several studies have tried to quantify the costs associated with unnecessary readmission.

- A study by Premier found that a typical hospital with 200–300 beds wastes up to $3.8 million per year, or 9.6% of its budget, on readmissions of patients who shouldn’t have to come back.

- Premier found that patients being treated for heart attacks, respiratory problems and major joint problems are most likely to be readmitted.

- Healthcare reform legislation links reimbursement to readmissions, medical errors and other hospital inefficiencies.

- Beginning in October 2012 (which is FY 2013 for CMS), hospitals ranked in the bottom 25% will see their Medicare payments reduced by 1% if they don’t cut back on readmissions.

- This penalty rises to 2% in FY 2014 and 3% in FY 2015. Penalties are getting the attention of hospital leaders.

- The initial focus of unnecessary readmissions is three conditions that represent 16% of readmissions: heart failure, pneumonia and acute myocardial infarction.

- Conditions that might be added (by 2015) are COPD, CABG, percutaneous coronary angioplasties and other vascular surgeries. These conditions represent almost 12% of preventable readmissions.

|

|

|

| McKesson Idea Exchange

|

- For your organization, how significant of a priority is reimbursement?

- What portion of your organization’s revenue comes from Medicare? How profitable/unprofitable are Medicare patients?

- What is your organization doing to improve the margins on Medicare patients?

- What steps is your organization taking to reduce readmissions

|

|

Back to Top

|

Key Topics

Topic 5: Innovation |

Hospitals are innovating their processes, their technologies, and their training and incentives. The goals of innovation include lowering costs and boosting patient satisfaction. |

|

|

| Automating Workflow Can Improve Quality, Save Money

|

- Benefits of automating drug delivery include:

- Increased pharmacy turns. In one example a hospital pharmacy’s inventory turns increased from 12 to 15 per year to 28 after automating workflow.

- Lower costs. Less inventory and more turns help a pharmacy reduce its drug costs.

- Increased capacity. Automating a hospital pharmacy’s workflow creates more capacity without adding staffing. The productivity per person goes up.

- Fewer missed doses. Automated workflow helps ensure the right dose to the right patient at the right time.

- Increased patient satisfaction. By automating the prescription-drug process, nurses spend less time dealing with prescriptions and more time with patients.

- Reinvestment. Money saved by automating pharmacy workflow can be reinvested in other areas.

- CPOE systems have improved some deficiencies between physicians and hospital pharmacy as pharmacy staff does not have to interpret physicians’ handwriting.

|

|

|

| Mobile Tech and Apps Improving Care and Patient Experience

|

|

Mobile technologies and use of iPads can improve care and the patient experience. Facts and examples include:

|

- Mobile health is now a $700 million market in the U.S.

- Mobile technology can help providers meet meaningful-use requirements and can be used to:

- Increase medication compliance. Technology can explain why adherence is important, can send messages about refills and can help reduce readmission.

- Improve post-treatment understanding. At discharge, patients are often overwhelmed with information. Mobile technology is a way to provide information to patients post-discharge, along with reminders.

- Provide patient access to health information. Mobile technology provides a way for patients to access information wherever they are, which addresses an element of Stage 2 Meaningful Use.

- Aggregate data on population health. Applications can track health outcomes.

- Ways iPads are improving the patient experience include:

- Replacing check-in forms. This replaces a paper-based system.

- Providing patient guides. Mayo Clinic uses an iPad with an app to guide patients through their hospital experience. Heart surgery patients are given an iPad to help them visualize and prepare for their plan of care.

- Customizing the MRI experience. An app lets patients select lighting, music, images and video during their MRI.

- Enabling virtual physician-patient communication. The Facetime feature on the iPad allows patients and physicians to engage in a video chat.

|

|

|

| Hospitals Innovating to Improve Patient Satisfaction

|

- Healthcare reform ties a portion of Medicare reimbursement to patients’ ratings.

- This is causing hospital executives to focus on the patient experience and patient satisfaction more than ever. Examples of the steps hospitals are taking include:

- Engaging and training staff on ways to satisfy patients. Cleveland Clinic put all 40,000 employees — from physicians to valet parkers — through a half-day training.

- Linking compensation with satisfaction.

- Offering new services, like massages and music therapy.

- Creating new patient experience leaders. Cleveland Clinic now has an “Office of Patient Experience.”

- Creating “strategy maps” so employees understand the strategy and what to do to improve satisfaction.

- These actions are working. Since 2008, Cleveland Clinic has increased employee engagement by 34% and satisfaction to 89%. Also, complaints decreased by 5% last year.

|

|

|

| McKesson Idea Exchange:

|

- How automated is the workflow in your pharmacy? What benefits has this yielded?

- Is your organization using mobile technology or iPads? If so, how? What other ways are you innovating in how you use technology?

- What innovations is your organization pursuing to improve patient satisfaction?

|

|

Back to Top

|

Key Topics

Topic 6: Alternate Site Pharmacy |

Alternate site pharmacies are working with LTC facilities to help them in important areas such as reducing readmissions, improving pain management and providing specialty drugs. |

|

|

| Just Like Hospitals, Long-Term Care Is Focused on Reducing Readmission

|

- Two long-term care organizations have launched an initiative that focuses on reducing hospital readmissions and reducing off-label use of antipsychotics in long-term care

- These groups want to reduce hospital readmissions by 15%, reduce turnover among nursing staff and raise customer satisfaction to 90% by March 2015

- In addition, these groups want to decrease off-label use of antipsychotics, which will help patients avoid health complications

- A separate article sees opportunities for decreased hospital readmission by partnerships between hospitals and short-term rehab facilities, SNFs and nursing homes

|

|

|

| Pain Management Is an Important Topic in Long-Term Care

|

- According to the NIH, up to 80% of nursing home residents are under-treated for pain.

- There are many barriers to treatment. Among them is timely access to controlled medications due to drug shortages.

- One effective technique: remote dispensing, which makes medication available around the clock. Once the pharmacist has signed and approved a Schedule II narcotic prescription, the medication is available for the nurse to administer to the resident.

- However, remote dispensing is only available in 14 states. Even where allowed, restrictions exist.

- If on-site dispensing isn’t available, facilities need to contract with pharmacies that offer 24-hour delivery service.

- Other alternatives: an emergency symptom kit with a few doses of pain medication and pharmacy-provided medication-management programs.

- New routes to drug delivery are available. There are new delivery options and new ways to give residents more control over the timing of their medications. Also, faster-acting extended-release formulations are now available.

|

|

|

| Use of Specialty Drugs Is Increasing in Long-Term Care

|

- Just as specialty drugs are increasing in the community setting, their use is also growing among pharmacies that service residents in senior-care settings.

- A 2011 MHA study showed growth in specialty pharmaceuticals from 2010 to 2011 of more than 10%. Continued growth is expected.

- In particular, use of biologics for inflammatory conditions, use of specialty medications to treat MS and use of oral oncology medications within alternate site pharmacies is increasing dramatically.

- Alternate site pharmacies have made significant investments in providing specialty services. Pharmacies are providing patient-education services, have invested in systems and have developed therapeutic protocols and programs.

- There are significant regulatory and personnel issues related to providing specialty drugs in LTC.

|

|

|

| McKesson Idea Exchange

|

- In what ways is your organization working with LTC facilities to help decrease hospital readmissions?

- How do you work with clients in providing pain-management services?

- What is your organization doing related to increased demand for specialty drugs?

|

|

Back to Top

|

Deep Dive

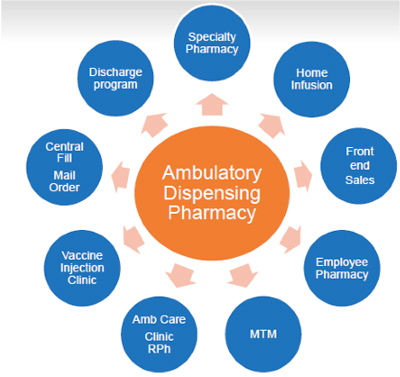

The Business Case for Ambulatory Pharmacy |

Health systems are adding or expanding ambulatory pharmacy, driven by financial factors and care considerations. This article defines ambulatory pharmacy, explains why health system leaders are paying attention to it and summarizes how they are thinking about it. |

|

|

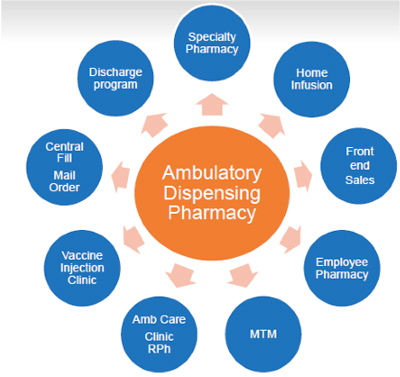

| What Is Ambulatory Pharmacy?

|

|

Ambulatory pharmacy is the emerging industry term for outpatient/retail pharmacies provided by health systems, clinics and other providers. An ambulatory pharmacy can provide medications to:

|

- Patients receiving outpatient or ED services and at discharge

- Patients needing to refill prescriptions or receive prescriptions at home via mail order after their hospital discharge

- Employees

|

|

Ambulatory pharmacies can be valuable for patients with complex situations who take multiple drugs, often for years. Unlike traditional retail pharmacies, which fill prescriptions for anyone, ambulatory pharmacies usually only fill prescriptions related to medical treatment at the facility.

|

|

|

| Why Is It Getting More Attention?

|

|

There are general and specific reasons why adding an ambulatory pharmacy or expanding one is occurring.

|

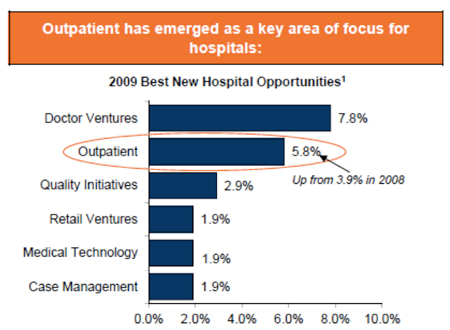

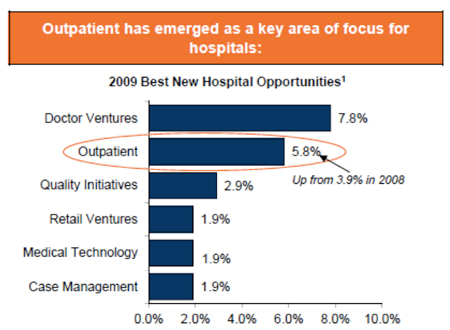

- In general, outpatient services are growing. Between 1988 and 2008 the percentage of total hospital gross revenue attributed to outpatient activity increased from 21% to 39%.i This trend is expected to continue, with outpatient visits expected to grow by more than 20% by 2019.ii And outpatient services continue to be a priority and an area of focus for many hospitals.iii

|

|

- Currently 34% of hospitals operate an ambulatory pharmacy. The percentage is higher among larger hospitals (59% of hospitals with more than 400 beds) and urban hospitals (48%).

The number of hospitals opening an ambulatory pharmacy is increasing. McKesson’s John Ryan, managing consultant, Pharmacy Optimization, McKesson Health Systems, sees “a renewed interest in ambulatory pharmacy.” And, University of Wisconsin’s Tom Thielke said, “Ambulatory pharmacy is the next frontier of hospital pharmacy practices.” Among hospitals with an ambulatory pharmacy, 58% plan to expand it.iv

Hennepin County Medical Center in Minneapolis, Minnesota, provides an example. Three years ago this hospital decided to expand its ambulatory pharmacy to serve not only discharged patients, but also patients in the ED. This has added more than 50 prescriptions per day.

|

|

|

| The Case for Ambulatory Pharmacy

|

|

Several factors are driving the heightened interest in ambulatory pharmacy. An ambulatory pharmacy:

|

- Provides financial benefits. For most hospitals this is the primary driver. The financial benefits include:

- Increased revenues from filling more prescriptions. The opportunity exists to fill prescriptions for patients after discharge. This revenue is important for hospitals struggling to sustain their margins. Jessie Morgan, manager of outpatient pharmacy services at the University of Louisville Hospital, said, “At the University of Louisville Hospital, we created a revenue stream from ED and discharge prescriptions.”v

Bruce Thompson, director of health system pharmacy services at Hennepin County Medical Center, said that after significant budget cuts, the health system’s leadership emphasized the importance of increasing revenue. Expanding the ambulatory pharmacy fit with this directive.vi The goal was not to make a profit, since Hennepin is non-profit, but to produce funds to reinvest in other hospital and pharmacy services.

- Decreased costs. Hospitals can manage their costs by filling more prescriptions in-house. Some hospitals provide significant incentives to do so.

- Improves patient care. Discharged patients often don’t fill their prescriptions, which results in a lack of adherence and unnecessary readmissions.

An ambulatory pharmacy can fill prescriptions and provide education and support. This ensures that patients leave the hospital with their prescriptions filled. This extends the continuum of care and has improved adherence and reduced readmissions.

The Medical University of South Carolina improved seven-day readmission rates for kidney-transplant patients by 50%. A key part of its success was prompting patients to fill their discharge prescriptions in their on-site pharmacy.vii

- Improves satisfaction. In addition to the cost and clinical benefits, an ambulatory pharmacy extends the hospital’s relationship with patients and employees, and can improve satisfaction. Patients like the comprehensive care and appreciate not needing to go to a retail pharmacy to fill prescriptions post-discharge. An ambulatory pharmacy can boost a hospital’s reputation, relationships, satisfaction and reimbursement.

- Builds a foundation for other services. By creating an ambulatory pharmacy, a hospital is better positioned to offer services such as medication therapy management (MTM), specialty pharmacy, home infusion and vaccinations.

|

|

|

In addition, an ambulatory pharmacy can play a key role in enabling a health system to deliver accountable care (and become an effective ACO). Bruce Thompson shared the results of an ACO pilot at Hennepin involving Medicaid patients. In this pilot, involving 8,000 people:

|

- Hospital admissions were reduced by 42%

- ER visits decreased by 37%

- The cost of care was lowered by $2,500 per participant

|

|

Thompson said, “Pharmacy was critical.” This is because 42% of the participating patients took 10 or more medications. By focusing on the major users, Hennepin’s ambulatory pharmacy captured 65% to 70% of the prescriptions. Patients were sent home with the right prescriptions, and MTM was initiated through the ambulatory pharmacy for targeted patients within three to five days post-discharge.

|

|

|

| Challenges and Solutions

|

|

Challenges in starting or growing ambulatory care pharmacy can include securing management support and investment, getting physical space, deciding on staffing and being technologically integrated with the rest of the hospital and health system.

John Ryan said it typically takes about six months to set up an ambulatory pharmacy, but ambulatory pharmacies can produce a positive ROI in a short period.

Bruce Thompson said Hennepin projected conservative prescription volume and quickly surpassed those projections.

John Ryan explained that the basic idea of ambulatory pharmacy is not complicated, but creating a retail pharmacy may not be an area where a hospital has much experience. For this reason, McKesson can offer significant value as organizations think through their decision and proceed to implement.

|

|

|

| More Information

|

|

Several articles discuss how and why health systems are pursuing ambulatory pharmacy:

|

|

|

|

|

| McKesson Idea Exchange

|

- What are your organization’s plans related to ambulatory pharmacy?

- What are your organization’s goals related to ambulatory pharmacy? What do you hope to achieve?

- What are your organization’s key factors behind establishing or growing your ambulatory pharmacy?

- What groups are you planning to serve through your ambulatory pharmacy?

- What do you see as the biggest challenges and obstacles related to establishing or growing your ambulatory pharmacy? What steps are you taking to overcome them?

|

|

|

- The Chartis Group, citing data from Avalere Health analysis of American Hospital Association Annual Survey data for community hospitals, 2008.

- The Chartis Group, citing data from The Advisory Board Company, “Forecasting Demand for Hospital Services: Evaluating the Impact of Near Universal Coverage Expansion,” 2010.

- From Citi 2009 Annual Nonprofit Survey; respondents primarily C-Suite.

- Pharmacy Purchasing & Products — 2011 Survey.

- “Practical Solutions to Outpatient Pharmacy Management,” Pharmacy Purchasing & Products, June 2011.

- Interview with Bruce Thompson.

- 2011 KLAS Report, Outpatient Pharmacy Goes Retail.

|

|

Back to Top

|