Key Metrics

A Snapshot of the Economic and Healthcare Landscape |

| |

Macroeconomic Snapshot

Economy remains stagnant. Growth modest at around 2%; unemployment largely unchanged. |

|

|

| Economic Growth (GDP) Slowly Improving

|

|

+1.5% in April–June 2011

– Experts have lowered estimates to 2% growth for 2012

|

|

|

| Inflation Remains Low

|

|

CPI is 1.7% in past 12 months (through June)

|

|

|

| Consumer/CEO Confidence

|

|

Consumer confidence fell in April, May, June

– CEOs pessimistic — only 17% claim conditions have improved versus six months ago, down from 67% last quarter

– Only 20% expect improvement in the next six months

|

|

|

| Unemployment Slowly Declining

|

|

8.2% in July, unchanged since March

– Jobless rate up in 27 states in June, down in just 11

|

|

|

Healthcare Snapshot

Hospitals expect revenues to decline, are focused on cutting costs. |

|

|

| Healthcare Spending

|

|

+6.14% over past 12 months, as of April 2012

– Costs from commercial insurance +8.46%; Medicare +2.6%

– Healthcare costs increased three times more than inflation

– PwC estimates growth of 7.0–7.5% from 2010–13

|

|

|

| Hospitals Expect Revenue to Shrink

|

| |

– ACA hailed as good news for hospitals due to increased patient volume

– But 55% of hospital executives anticipate a decline in revenue

|

|

|

| Outlook for Hospitals Is Negative

|

| |

– First quarter of 2012 Moody's reported an equal number of upgrades and downgrades for nonprofit hospitals

– Moody's expects more downgrades than upgrades for rest of 2012

|

|

|

| M&A Remains Strong

|

|

|

– M&A more than doubled in Q2 vs. Q1

– Service areas with most M&A activity are:

|

|

|

- Long-term care — 35 deals worth $1.9B

- Hospitals — 22 deals worth $4.5B

- Physician groups — 21 deals worth $4.2B

|

|

|

| Hospitals' Main Financial Issues

|

|

|

– LEK Consulting sees issues facing hospitals:

|

|

|

- Controlling costs

- Improving quality

- Maintaining reimbursement

- Data connectivity

|

|

|

| Families Now Pay More

|

| |

– Cost of care for family of four exceeds $20,000

– On average, families pay 42% of medical costs, highest share ever

|

|

|

| Key Hospital Strategies

|

|

|

– An AHA report listed 10 must-do strategies

|

|

|

- Aligning hospitals and providers across the care continuum

- Using evidence-based practice to improve quality, patient safety

- Improving efficiency

- Developing integrated information systems

- Integrating provider networks and care systems

- Educating and engaging employees and physicians

- Strengthening finances to facilitate reinvestment and innovation

- Partnering with payers

- Engaging in scenario-based strategic planning

- Managing population health to improve “triple aim”

|

|

|

| Enrollment in HSAs, High-Deductible Plans

|

|

Participation in high-deductible health plans grew 18% in 2012

– Now 13.5 million Americans with HSAs

– Those in HSAs had 7% lower health costs, got more

preventive care

|

|

|

| McKesson Idea Exchange

|

- Looking ahead, what are your hospital's key strategies for controlling costs while also improving quality measures?

- What is your hospital currently doing to align with providers across the patient-care continuum?

- What have been your spending and financial trends? Do you see this changing?

- What are the top financial pressures on your hospital? What are your priorities in addressing these challenges?

|

|

Back to Top

|

Key Topics

Topic 1: Public Policy |

The U.S. Supreme Court ruled that ACA is constitutional. Most hospitals and healthcare organizations support the ruling — and healthcare reform continues. |

|

|

| Supreme Court Rules PPACA Is Constitutional

|

- On June 28, 2012, the U.S. Supreme Court ruled that healthcare reform legislation is constitutional.

- Hospital associations agreed. Even though reimbursement will be cut and new payment models will be tested, ACA should:

- Increase access to hospital care, which means increased volume for hospitals

- Decrease unreimbursed care, since more people will have insurance

- Even before this ruling, hospitals had adopted strategies of consolidation, investing in technology and revising processes to improve efficiency.

- Other providers largely supported the decision but vowed to repeal pieces they find objectionable.

- The Court's decision removes one layer of industry uncertainty, but uncertainty still remains related to the election. Republican presidential candidate Mitt Romney has promised to repeal healthcare reform on his first day in office.

|

|

|

| Post-Ruling, Reform Continues Full Speed Ahead

|

- A report by PwC about the implications of the Supreme Court ruling concludes that it injects a sense of urgency into the transformation of healthcare.

- Implementation deadlines are rapidly approaching, pressuring organizations to meet them.

- The Supreme Court’s decision focused on the individual mandate. Other generally supported aspects of ACA include:

- Tying provider reimbursement to quality measures

- Value-based purchasing

- Creation of Medicare ACOs

- Pilots to test bundled payments

- Each of these areas is proceeding.

- Effective July 1, 2012, CMS added 89 new ACOs. The total

is now 154 Medicare ACOs in 40 states, serving more than

2 million Medicare beneficiaries.

- For 2012, CMS has established 33 quality measures for ACOs.

- CMS announced that applications to become a Medicare ACO will be accepted annually. Already, 400 organizations plan to apply to begin in January 2013.

|

|

|

| Pharmacists Seek to Play a Greater Role Post-Reform

|

- Pharmacists want to leverage changes initiated by healthcare reform to redefine their role

- Organizations representing pharmacists say pharmacists want to be part of improving healthcare

- They want to be part of care teams that improve quality, improve hospital discharge process, deliver medication therapy management, improve medication compliance and lower costs

|

|

|

| McKesson Idea Exchange

|

- What is your reaction to the ruling that ACA is constitutional? How does this affect your hospital's strategy and plans going forward?

- How will healthcare reform change the role pharmacists play? What changes in the pharmacists' role are taking place currently?

- Since ACA includes value-based purchasing, new quality measures, the ability to become an ACO, and more — what impact do you see ACA having on your operations?

- How does ACA affect the priorities of your hospital? Of pharmacy?

|

|

Back to Top

|

Key Topics

Topic 2: Quality and Patient Safety |

Soon, hospital quality won't just be “nice to have” but will affect reimbursement. The involvement

of pharmacists, especially related to discharge, can improve medication adherence and decrease readmissions. |

|

|

| Starting Soon, Provider Compensation Will Be Linked

with Quality

|

- Effective October 1, 2012, hospitals will have financial incentives tied with their quality results.

- Hospitals delivering higher-quality care will be rewarded with higher reimbursement; those delivering lower-quality care will be penalized with lower reimbursement.

- Incentives will be funded by a reduction in DRG payments

of 1% in fiscal 2013, growing to 2% in fiscal 2017. Hospitals will pay into this pool; those that score well will be paid out

of this pool.

|

|

Strategies for improving performance at one hospital include:

|

- Understanding the definition for each quality measure

- Ensuring proper care processes are in place to deliver high quality

- Having a process for monitoring quality results in real time

- Being prepared to respond quickly to fix any problems

|

|

|

| Pharmacists on Care Teams Can Improve Adherence

|

- Research shows poor medication adherence can cause unnecessary hospital visits.

- Many hospitalizations and ER visits can be avoided with proper medication adherence.

- Fierce Healthcare writes: “Healthcare organizations can include pharmacists in care teams to help patients take their medication as prescribed and avoid costly preventable hospital stays, according to researchers.”

|

|

|

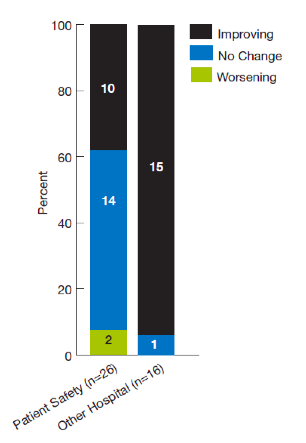

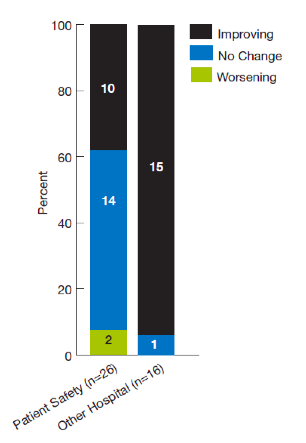

| Improvements in Safety Lagging Other Hospital Quality Measures

|

- 2011 AHRQ Report tracked 16 measures related to hospital quality (but not safety). Almost all showed improvement.

- But, of 26 measures related to hospital safety, only 38% showed improvement and two worsened.

- So, hospitals are improving their patient safety, but more slowly than their overall quality.

|

|

|

|

| McKesson Idea Exchange

|

- Is your hospital focused on any quality-improvement measures to maximize reimbursement? How so?

- What action is your hospital currently taking to improve performance and quality?

- Many hospitals are involving pharmacists in care teams and the discharge process to improve patient outcomes. Is your organization doing anything like this? How is it working?

- What steps has your pharmacy taken to improve quality and safety? What have you learned from this process?

|

|

Back to Top

|

Key Topics

Topic 3: Supply Chain |

New research shows advantages of distributors in hospital procurement. Other research shows that supply chain savings won't be adequate for hospitals to survive; other sources of savings are needed. Separately, a new law to reduce drug shortages gives hospitals greater flexibility. |

|

|

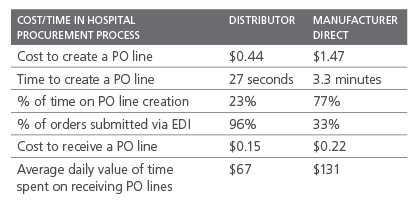

| Hospital Supply Chains Go through Stages of Maturity

|

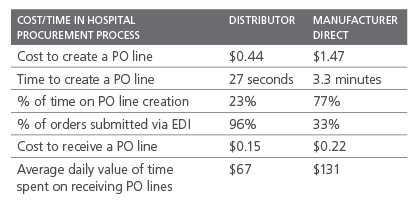

- Recent research by PwC for the Health Industry Distributors Association shows:

- Internal process costs for procurement/ordering are lower with a distributor than from a manufacturer. Distributors are more efficient.

- Use of automation to create purchase orders increases

efficiency. Distributors are more adept at using

automation.

- Distributors' use of advance ship notice reduces receiving time.

- Transportation costs are lower for distributors; higher for direct-buy products.

- Overall, hospitals get greater efficiencies on purchases through distributors than direct from manufacturers

- Report recommends that hospitals increase share of regularly purchased supplies through a prime-vendor distributor

|

|

|

|

| Savings from Supply Chains Aren't Adequate

|

- Research from Booz & Company indicates that hospitals need cost savings of 10% or more to survive

- Levers hospitals usually pull are supply-chain savings initiatives, capital spending freezes and head-count reductions

- But fewer than 23% of hospital executives believe these actions will be adequate

- Hospitals must engage in a fundamental transformation that involves redesigning care processes, unleashing capacity and supporting a cost structure that locks in savings

|

|

|

| President Signs Act to Reduce Drug Shortages

|

- On July 9, 2012, President Obama signed the Food and Drug Administration Safety and Innovation Act.

- This act included provisions to alleviate critical drug shortages. Among the key provisions:

- More drug manufacturers will need to report shortages. Previously, reporting was largely voluntary; now it is mandatory for life-supporting drugs.

- Hospitals can repackage drugs in short supply.

- Hospitals can request expedited drug approval.

- A Bloomberg article indicated that even before this act, since the president had directed regulators to act to prevent shortages, the number of drug shortages has fallen by more than 50%.

- Still, a recent Washington Post article explains that drug shortages continue, requiring hospitals to invest considerable time and effort scrambling to find alternatives.

|

|

|

| McKesson Idea Exchange

|

- How does your organization think about what to buy from a manufacturer vs. from a distributor?

- How do you think about and measure the procurement process?

- In what ways is your hospital looking beyond the supply chain for significant savings?

- What has been the impact of drug shortages on your hospital? What do you think the impact of the new act to alleviate shortages will be? What best practices would you share with your colleagues in dealing with this challenge?

|

|

Back to Top

|

Key Topics

Topic 4: Reimbursement |

Hospital leaders expect the nature of reimbursement to begin changing in the next few years to more risk-based reimbursement. Early adopters are participating in ACOs and other shared-savings programs. |

|

|

| Hospitals Have High Uncertainty about Medicare and Medicaid Reimbursement

|

|

Medicaid

|

- 30 states have budget shortfalls, and Medicaid is a large component (averaging 13%) of state budgets.

- This will grow. Under ACA, 16 million more people are expected to be covered by Medicaid.

- The CBO projects that states will see a 2.8% increase in

Medicaid costs due to expanded enrollment.

- Cutting Medicaid is a common target for state budget

balancing, causing hospital uncertainty.

|

|

Medicare

|

- Congressman Paul Ryan's budget plan calls for over $200 billion in Medicare cuts and privatizing part of Medicare. Medicare cuts are part of the budget conversation.

- According to Fitch Ratings, every 1% cut in Medicare rates decreases hospital operating margins by 40 basis points.

|

|

|

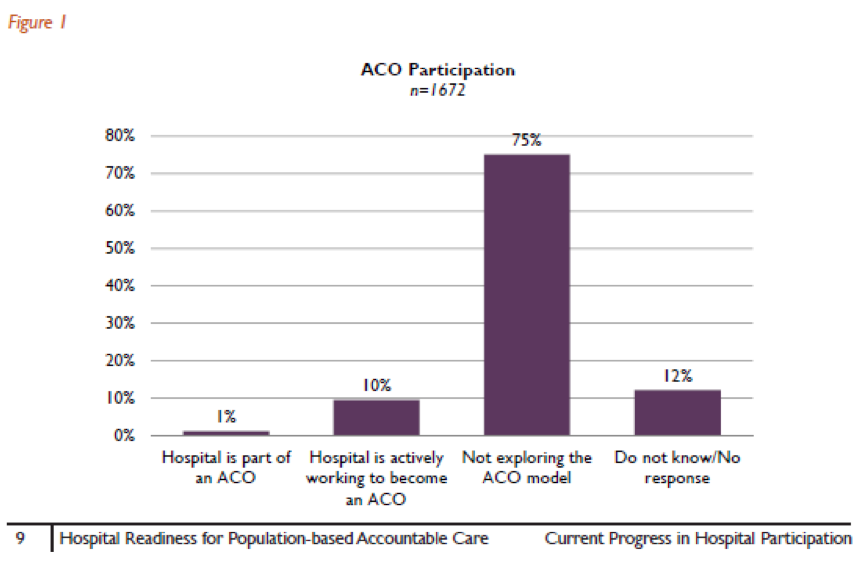

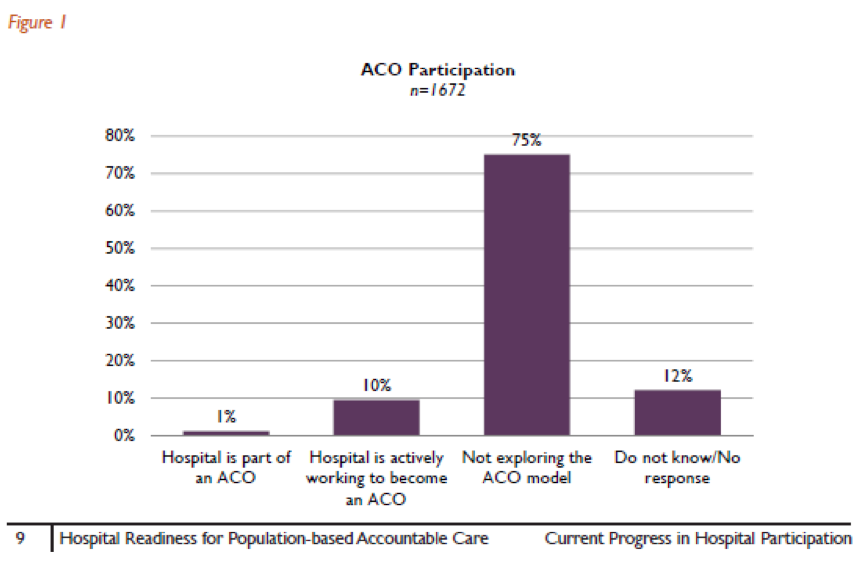

| About 10% of Hospitals Plan to Participate in an ACO

|

- Currently, only 1% of hospitals are in an ACO, but 10% plan to be (see chart below)

- Many plan to participate in a ”shared savings“ program

- 75% are not currently exploring becoming an ACO

|

|

|

|

| Hospitals Expect Revenue from Risk-Based Reimbursement

to Double

|

- A report by the AHA finds that risk-based reimbursement is 9% of hospital revenue.

- Hospitals expect this to grow to 18% in the next two years.

- The 9% growth is expected to come from bundled payments (+6%) and global capitation (+3%).

- However, 84% of hospitals that don't plan to become an ACO are not considering bundled payments in the next 12 months.

- In Massachusetts, which is ahead of the rest of the country, one in five patients is under global payment. Spending has been reduced as physicians send patients to lower-cost hospitals.

|

|

|

| McKesson Idea Exchange

|

- How is your hospital thinking about and planning for possible reductions in Medicare and Medicaid reimbursement?

- How would cuts affect pharmacy operations?

- Are you in the 10% of hospitals that plan to be part of an ACO in the next year, or the majority who don't plan to be right now? How does this decision and planning affect pharmacy moving forward?

- Regardless of whether your hospital plans to be part of an ACO, what changes are being made to improve care coordination? How does this affect the role of pharmacy?

|

|

Back to Top

|

Key Topics

Topic 5: Innovation |

With ACA ruled constitutional, the focus is on implementation — which requires massive innovation to transform how care is delivered. Hospitals must create a culture of innovation. |

|

|

| Survival Requires Transformation and Innovation

|

- Over the past four decades the primary challenge hospitals faced was meeting growing demand.

- But the world has changed. Employers and policymakers are now focused on controlling costs.

- We are entering an era of increasing volume and low- or no-growth reimbursement.

- Hospitals need to lower costs 10% to 20%.

- One health leader estimates clinical processes account for 85% of the cost of care. So, to achieve 10% to 20% savings, hospitals need to redesign their clinical-care processes.

- For example, hospitals must redesign an episode of care that costs $15,000 to get it to $12,000. This will be necessary to confidently enter into contracts for bundled or global payment.

|

|

|

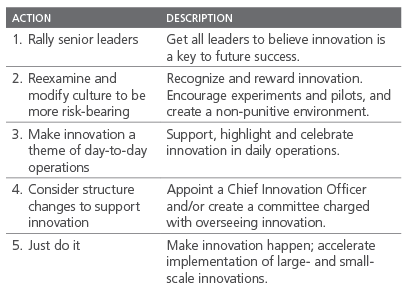

| Health Systems Must Create a Culture of Innovation

|

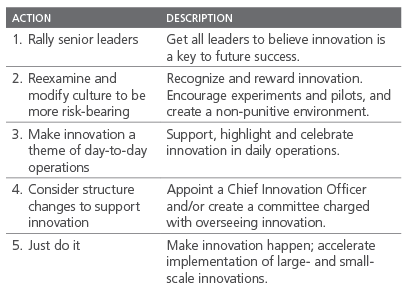

- A recent article said hospital leaders must innovate how they lead. They must:

- Reshape the cultures of their organizations to make them more adaptable, flexible and risk-bearing

- Get all leaders to accept responsibility for innovation as part of their core role

- Operationalize the search for innovative opportunities and implement them

- The article suggested five actions to launch innovation:

|

|

|

|

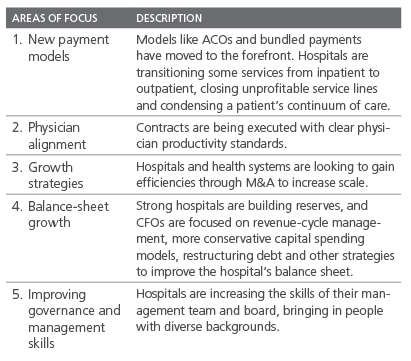

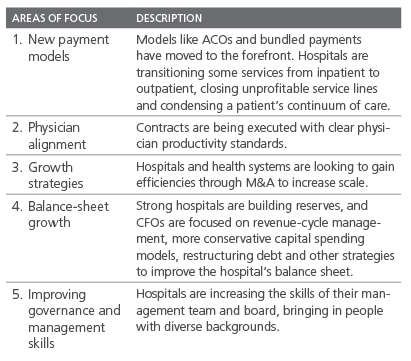

| What High-Performing Hospitals Are Focused On

|

- Moody's described the five most prominent areas of focus of high-performing hospitals. They are:

|

|

|

|

| McKesson Idea Exchange:

|

- What is your hospital doing to transform itself? What are your major priorities? Initiatives?

- What is the attitude toward innovation? Is it part of the culture? Who is responsible for it? What major innovations are underway in pharmacy?

- Which of the priorities of high-performing hospitals fit with priorities at your organization?

|

|

Back to Top

|

Key Topics

Topic 6: Alternate Site Pharmacy |

Alternate site pharmacies can offer great value when they partner with administrators to decrease costs and help reduce hospital readmissions. (For more on preparing for short-cycle dispensing, see Deep Dive II.) |

|

|

| Value of Alternate Site Pharmacies

|

|

A Fitch Ratings report about LTC pharmacies explained that:

|

- Most nursing facilities and institutional healthcare providers outsource pharmaceutical procurement and dispensing to LTC pharmacies

- LTC pharmacies provide value by going above and beyond services provided by retail pharmacies

- They promote drug-formulary compliance, train clinical staff in drug dosing and administration, pack drugs in unit doses and have on-call pharmacists to assist in emergencies

- The biggest challenge for LTC pharmacies is maintaining profitability by negotiating rebates from drug manufacturers

|

|

|

| CMS Decides NOT to Require Pharmacist Independence

|

- In October 2011, CMS said it was considering requiring nursing facilities to obtain consultant pharmacy services from pharmacists independent of the facility's LTC pharmacy.

- The reason was concerns of conflicts of interest.

- In the final rule, published in April 2012, CMS did not require an independent pharmacist. But, CMS may revisit this if conflict concerns persist.

- Alternate site pharmacy organizations agreed with this decision.

- CMS recommends that LTC pharmacies develop performance measures.

|

|

|

| Hospital Penalties for Readmissions Will Drive Cooperation with Alternate Sites

|

- Effective October 1, 2012, hospitals with high readmission rates will receive lower payments, starting at a 1% reduction and growing to a 3% reduction in 2015.

- Nearly one in five Medicare patients discharged from a hospital is readmitted within 30 days. LTC facilities are a leading source of hospital readmissions. Many readmissions are unplanned and result from uncoordinated, poor-quality care.

- Now, hospitals have a financial stake in low readmissions, and are interested in working with LTC facilities to decrease readmissions. (See article in H&HN.)

- Better management of medications will play a key role.

|

|

|

| When LTC Administrators and Pharmacists Collaborate,

Savings Are Possible

|

|

In a June webinar sponsored by McKesson, leaders from alternate site pharmacies discussed the need for collaboration between administrators and consultant pharmacists.

|

- The context: Due to federal and state funding cuts, LTC providers are operating on increasingly thin margins.

- So, facility administrators are approaching LTC pharmacies about strategies to cut medication costs.

- One participant emphasized that the industry will go through a big paradigm shift in the next five years. Technology will improve efficiency and reduce waste and costs.

|

|

|

| McKesson Idea Exchange

|

- What are the primary ways your pharmacy delivers value for your skilled nursing facility customers?

- What are you currently doing to help SNFs reduce their costs? What changes are you making? How does this involve your pharmacy and the way it operates?

- What are you doing to reduce your own costs and improve efficiency? What steps are you and the facility taking together?

|

|

Back to Top

|

Deep Dive I

The Generics Cliff |

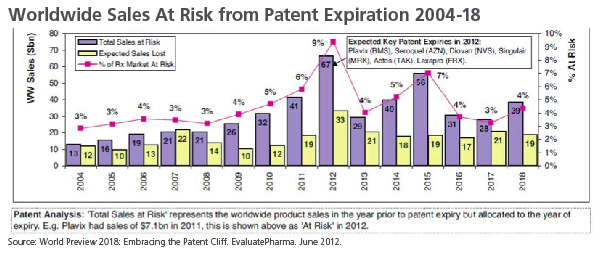

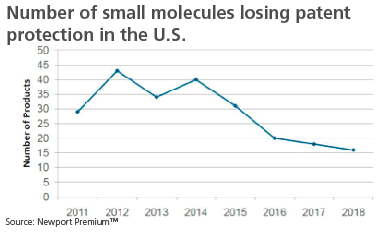

With over 40 drugs going off patent, 2012 has been characterized as the "biggest patent cliff ever." Converting to generics is a game changer for hospital pharmacies and alternate site pharmacies, as well as for McKesson. The key reason: margins on generics are considerably higher. |

|

|

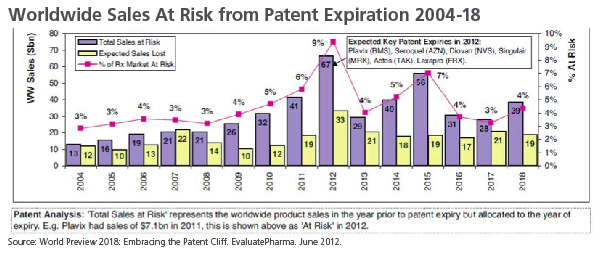

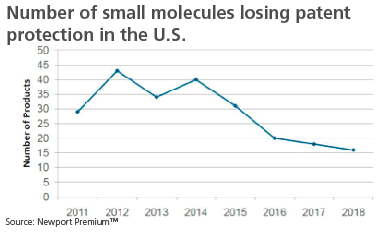

| Facts about the 2012 Generics Cliff

|

|

Brand-name drugs have been going off patent for years. As a result, IMS Health estimates that generics represent 80% of all drug prescriptions. Patent expirations over the past half-decade are a major reason why Medicare spent billions of dollars less on drugs than federal officials projected.

The generics cliff is expected to peak in 2012, with over 40 drugs scheduled to go off patent. These include blockbusters like Plavix, Seroquel, Diovan, Singulair, Actos and Lexapro. In 2013 and 2014, fewer medications are expected to go off patent and starting in 2015, the numbers decrease significantly.

|

|

|

| Issues for Hospital Pharmacies

|

|

The strategy used by most hospital pharmacies is to switch to generics as quickly as a branded drug goes off patent. Generics alleviate concerns about drug shortages, since they are typically manufactured by more than one supplier. In addition, hospitals find generics attractive because they reduce the financial risk associated with branded drugs. Specifically:

|

- Less expensive generics have lower inventory carrying costs

- The reimbursement risk associated with generics is less

- The profits associated with generics are usually not a significant factor for hospitals, which typically make their money on services/procedures

|

|

Converting to generics, however, can be complex for hospitals. There are several factors that may delay a hospital pharmacy from immediately switching:

|

- Administrative issues. Hospital pharmacies may need committee reviews and various administrative steps.

- Exclusivity issues. If there are only one or two generic suppliers, hospitals are less motivated to switch.

- Physician prescribing habits. Some doctors resist switching to generics, especially in academic settings. In addition, higher-acuity patients may require branded medications. As a result, hospitals are often forced to carry both generics and branded drugs.

|

|

|

| Issues for Alternate Site Pharmacies

|

|

The majority of LTC pharmacy business is oral solid medications. Although margins may be higher on generics, LTC pharmacies view new generic introductions as a significant hit to their total profitability. Revenues are decreased, often significantly, due to lower drug prices. But operating costs such as delivery and labor continue to rise. In addition, reimbursement policies can result in LTC pharmacies getting paid less than their acquisition cost for generics.

Some of the specific issues for alternate site pharmacies include:

|

- Prescription drug plans (PDPs) often play games with reimbursements and maximum allowable costs.

- The maximum allowable cost (MAC) for a generic can fluctuate based on market conditions or whether a company stops manufacturing the drug. If a MAC increases, PDPs may not update reimbursement levels in a timely way.

- If there are multiple manufacturers, a single generic can have multiple MAC levels. Some PDPs choose the lowest.

|

|

To minimize the negative impact of generics on their business, alternate site pharmacies have adopted a variety of strategies:

|

- Automation. Larger pharmacies often use automation to reduce costs. Remedi SeniorCare, for instance, transformed its business model through automation. This not only reduced operating costs, it differentiated the company in the market by satisfying customer needs.

- Use outsourcing to lower labor expenses. It makes financial sense for some LTC pharmacies to outsource certain activities. Senior Care Pharmacy Services opened a 50-person office in India that handles administrative work for its three U.S. pharmacies.

- Decrease inventory levels. Some LTC pharmacies segment their inventories by cost and usage, then align inventory levels with those segments. For example, Senior Care Pharmacy Services maintains a three- to six-month supply of inexpensive, high-utilization drugs; a one- to two-month supply of drugs that are more expensive and used less frequently; and a 10-day supply of high-end products.

|

| How McKesson Can Help

|

|

Pharmacists are eager to learn about upcoming generic launches. This opens the door for McKesson to help hospital and alternate site pharmacies. The following approaches may be helpful:

|

- Educate customers about upcoming generic launches. Pharmacists are interested in knowing precisely when generics will be available and whether they will be manufactured by one exclusive supplier, co-exclusive or multi-player. Frequently share the generics launch schedule from the MHS Generics Program's monthly newsletter.

- Have candid conversations with hospital customers about generics. Know which drugs and what quantities each pharmacy purchases. Show the magnitude of the 2012 generics cliff and demonstrate the total cost of not switching — and the advantages of switching quickly.

- Explore issues that might affect conversion. Factors like bottle size (which can affect automation), pill color and price may be important decision criteria for pharmacies. McKesson can accommodate many issues, if they are known up front.

- Work with alternate site pharmacies to reduce inventory and other expenses. McKesson's Six Sigma Consulting is ready to identify process improvements for pharmacies that can reduce costs as top-line revenues decrease due to generics.

- Illustrate how pharmacies can maximize their buying power.

- Coordinated buying, system-wide. In systems with multiple hospitals, each hospital may pick a different generic, minimizing the system's buying power. Ask whether McKesson can help make connections between system hospitals.

- McKesson's OneStop program. This program offers pharmacies immediate access to new generic introductions. It provides the best service levels, competitive pricing and simple purchase processes. When customers select autosubstitution, McKesson automatically sends generics from manufacturers with the best prices.

- McKesson's ASAP and ASAP+. These programs expedite shipment of new generic launches to customers and offer price protection for 30 days.

|

|

|

| Additional Resources

|

|

|

|

|

| McKesson Idea Exchange

|

- What is your organization's plan for taking advantage of the 2012 generics cliff?

- Have you considered the financial cost of not switching as soon as generics become available?

- What factors affect whether your organization purchases generics? Are they primarily organizational factors? Are there packaging-specific factors?

- Are generics purchases coordinated system-wide to maximize buying power?

- Are there ways McKesson can help you manage your inventory more effectively to reduce costs?

- How can McKesson support you in making the conversion to generics?

|

|

Back to Top

|

Deep Dive II

Short-Cycle Dispensing Rules for Alternate Site Pharmacy |

New short-cycle dispensing regulations go into effect January 1, 2013. Here is what you need to know to help your customers. |

|

|

| Background

|

|

Over $100 million worth of drugs distributed by alternate site pharmacies are wasted. Estimates from CMS indicate that 75% to 80% of wasted medications come from approximately 20% of drugs. Most of the medications in that 20% are branded drugs. To address this, CMS has implemented new regulations that will require all pharmacies serving LTC facilities to implement "short-cycle dispensing" by January 1, 2013.

Provided is a summary of the regulation, implications for pharmacies and what actions pharmacies are taking.

|

|

|

| Short-Cycle Dispensing: the Regulation

|

|

A recent study by Managed Solutions, LLC1 found that unused Medicare Part D prescription drugs dispensed in skilled nursing facilities represent approximately $125 million annually.

To reduce pharmaceutical waste and save money for CMS, Section 3310 of the Affordable Care Act (ACA) mandates short-cycle dispensing. There are two primary components of the regulation:

1) 14-day dispensing for solid oral doses of brand-name drugs, and 2) mandatory reporting requirements.

|

- Who is affected? All Medicare- or Medicaid-certified facilities must comply. Exceptions are assisted living, mental health, and Indian and urban tribal facilities. This means that all pharmacies serving LTC facilities are affected, including closed-door LTC pharmacies, retail pharmacies and mail-order pharmacies.

- What products are covered? Today, most medications for LTC facilities are dispensed in a 30-day cycle. Starting January 1, 2013, all solid, oral, branded products must be dispensed to patients in increments of 14 days or less. This includes controlled substances. Generic drugs are exempt.

- What information must be reported? LTC pharmacies must report on unused drugs, as well as dispensing methodologies. Details include:

- Unused drugs can be calculated by pharmacies, using the difference between the amount dispensed and the amount consumed. Reporting on unused drugs applies to both brand-name and generic medications.

- Pharmacies that voluntarily adopt seven-day-or-less dispensing for both brand-name and generic drugs will be exempted from the requirement to report on unused drugs to Part D plans.

- To identify the dispensing methodology used for each drug-dispensing event, pharmacies must enter codes developed by the National Council for Prescription Drugs Program (NCPDP) on billing transactions.

- Dispensing-methodology data will be used by CMS to determine whether dispensing requirements are reducing unused drugs. This information will also help determine whether the short-cycle program should be extended to generics in the future.

|

|

|

| Issues for Pharmacies

|

|

Many pharmacies serving LTC facilities already use short-cycle dispensing. Since LTC facilities pay for Part A drugs out of per-diem payments, they often require LTC pharmacists to use 7- or 14-day dispensing methodologies to limit exposure to costs associated with unused drugs.

However, as pharmacies transition to the short-cycle dispensing requirements, some may face additional costs related to:

|

- Dispensing methodologies. CMS defines the dispensing methodology as both the packaging system and the dispensing increment. Part D plans must permit pharmacies to implement uniform dispensing techniques selected by each LTC facility. An LTC facility may select multiple dispensing methodologies. For example, an LTC facility may use one dispensing methodology for brand-name Part D drugs, one for generic Part D drugs and a third for drugs dispensed to non-Part D patients.

- Dispensing fees. Since short-cycle dispensing will lead to more frequent scripts, dispensing fees may increase. CMS has assumed that the current aggregate level of dispensing fees will double.

- Shipping, transportation and delivery expenses. Increased scripts may lead to additional shipping costs. If allowed by state law, common carriers may be used to make deliveries from pharmacies to LTC facilities.

|

|

|

| Strategies Pharmacies Are Using

|

|

The following strategies are being used to deal with the impending short-cycle dispensing regulation:

|

- Punch cards/blister packs. The majority of LTC pharmacy providers (83%) use this technique in 30-day quantities. In the short term, CMS anticipates that most pharmacies will convert to a 14-day punch-card system. This is expected to require minimal capital investment.

- Dispensing automation. Automation can lower costs by reducing order processing and handling. Remedi SeniorCare recently changed its business model and moved to a 24-hour unit dose system for all drugs. This has reduced costs, improved customer satisfaction and exempts the company from short-cycle reporting rules. Although automated dose dispensing results in the fewest medication errors, it may not be practical for some LTC pharmacies due to their size and the capital required. Other obstacles to adoption include state pharmacy board restrictions, lack of interface standards between medical record and pharmacy systems, and inventory considerations.

- Third-party packaging models. This solution can be a good stop-gap measure until an LTC pharmacy adopts an in-house solution that meets short-cycle dispensing requirements.

- Standardizing processes. Some LTC pharmacies like Remedi SeniorCare standardize their dispensing processes across both branded and generic drugs to simplify operations. CMS encourages short-cycle dispensing for generics on a voluntary basis.

|

|

|

| How McKesson Can Help Pharmacies Comply

|

|

The approach that alternate site pharmacies take to comply with short-cycle fill requirements will depend on factors such as their size and ability to make capital investments. There are a variety of ways McKesson can help customers deal with these new regulations:

|

- By talking about which drugs are subject to short-cycle fill requirements. Know the drugs a pharmacy purchases and which will be affected by the new regulations. Keep in mind that the short-cycle fill dispensing requirements are limited to branded, oral, solid medications. The reporting requirements, however, apply to both branded and generic prescriptions.

- By briefing customers about different approaches to satisfying the short-cycle fill regulation. LTC pharmacies still have several months to develop a strategy for meeting short-cycle fill requirements. Consider briefing customers about the details of the regulation and discuss different solutions. Some organizations may want to create a differentiated service offering based on automation, while others may prefer a low-cost approach based on segregating affected drugs and only using short-cycle fill dispensing for them.

- By explaining how McKesson repackaging solutions address short-cycle fill needs. McKesson has teamed up with Safecor Health as its preferred medication repackaging partner. After LTC pharmacies order medications through the McKesson ConnectSM portal, Safecor Health can repackage oral solids and oral liquids in virtually any format, including 7- or 14-day short-cycle fill bingo cards. McKesson's partnership with Safecor Health reduces the capital investment, labor space and inventory costs associated with short-cycle fill compliance.

- By discussing how McKesson can help with automation and process improvements. McKesson's Parata Systems offers next-generation pharmacy-automation solutions that can help with short-cycle fill dispensing. McKesson's Six Sigma Consulting is also an option for LTC pharmacies who want to reevaluate their processes, in light of the short-cycle fill regulation.

|

|

|

- Measurement of Unused Medication in Medicare Part D Residents in Skilled Nursing Facilities. Managed Solutions, LLC. January 12, 2011.

|

|

|

| Additional Resources

|

|

|

|

|

| McKesson Idea Exchange

|

- Have you estimated what percentage of your current oral solid branded medications are dispensed in 30-day cycles and will be impacted by CMS's short-cycle requirements?

- Have you adopted short-cycle dispensing practices for your LTC customers?

- Which aspect of the short-cycle regulation will be most challenging for you — the dispensing or reporting requirements?

- Is your organization investing in automation to handle short-cycle dispensing? If not, what dispensing methodologies are you using?

- Did you know that medications ordered through McKesson Connect can be repackaged into 7- and 14-day short-cycle formats by our partner Safecor Health?

- McKesson's Parata Systems offers innovative automation solutions for pharmacies. Would you be interested in learning more about how our systems help with short-cycle fill compliance?

- McKesson's Six Sigma Consulting team is available to help LTC pharmacies evaluate their processes and operations. How would this service be beneficial as your organization transitions to short-cycle dispensing?

- What else could McKesson do to assist in dealing with the impending short-cycle dispensing requirements?

|

|

Back to Top

|